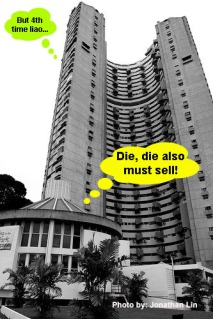

Pearl Bank Apartments near Chinatown is back on the market again – this time at a lower price.

The owners have followed the lead of some other collective sale projects by trimming their expectations.

They are now hoping for $725 million.

The 280-unit project had an estimated price of $750 million when it was launched for sale in March this year.

A number of projects mounting collective sales have cut their asking prices in a bid to close their deals in the light of global market uncertainties.

The new price works out to $1,314psf ppr, including a lease top-up of about $162 million and a 10% balcony allocation, marketing agent Knight Frank said. There is no development charge payable for the site.

The development has about 65 years left on its 99-year lease.

The site has a land area of about 82,379sqft and is zoned for residential use with a 7.2 plot ratio. It has a gross floor area of about 675,000sqft, and can yield more than 500 apartments of 1,200sqft each.

The building has been hailed as one of Singapore’s architectural landmarks. The URA said in March that the public had asked for the horse-shoed shaped tower to be conserved.

This is the fourth time that the 37-storey development has been put up for en bloc sale. The tender for Pearl Bank Apartments will close at 3pm on Nov 3.

Experts say the gloomy economic outlook made it even more difficult for mega collective sale sites of over $500 million to find buyers – so owners are starting to moderate their expectations.

Developers prefer to deal with projects with price tags of under $100 million as such sales involve less risk, they add.

Mr Nicholas Wong, Knight Frank’s head of investment, noted that there have been eight to nine of such mega collective sale sites. These include Laguna Park, Hawaii Tower and Pine Grove.

Interest in such sites has been muted, partly due to the worsening economic climate and the Government’s ample release of state land, which has siphoned capital away from collective sale sites.

Mr Wong said that while there were expressions of interest from developers when Pearl Bank was first launched for sale in March, the shaky global recovery even back then had spooked developers.

“But larger sites like these are attractive to some developers, as they are in more mature areas, while the government land sale sites are mostly in new towns.”

Owners of freehold condo Tulip Garden in District 10 re-launched their collective sale bid at $600 million in June, down from their $650 million price tag in January. There has been no news on whether the site has been sold.

But other collective sales have found success after owners brought down their prices.

Whitley Heights off Whitley Road, for example, reduced its asking price from between $185 million and $210 million, to $165 million. It was eventually sold at just under the price target, at $159 million last month.

Source: The Straits Times/The Business Times

It seems like the laylong-ing of older estates has started even before 2013. If the wife and I are developers, we be sitting gleefully by the sidelines waiting for the asking prices of collective sale projects to drop even further…

Click on link below to read our previous post on the Pearl Bank collective sale:

http://sgproptalk.blogspot.com/2011/04/enbloc-news-pearlbank-apartment.html

http://sgproptalk.blogspot.com/2011/03/enbloc-news-pearl-bank-apartment-take-3.html

.